Keeping Up with the Zenput Blog: Follow Along with Us on Crunchtime.com

Same great blog content; new destination. We’re not good at goodbyes, so instead of saying a final farewell, we invite you to keep up with Zenput and...

The ROI of Operations Execution: Avenues for Restaurant Improvement

Restaurant operators are always looking for ways to elevate their restaurant teams to achieve not just operations execution but operational excellence...

5 Ways Quick Service Restaurants Are So Quick

There are many reasons why consumers choose quick-service restaurants– convenience, affordability, consistent product, and most of all: speed of...

The Triangle Rule: Why Kitchen Efficiency Matters in Multi-Unit Restaurants

In home kitchens, there is a best-practice called the triangle rule, where the distance of the triangle legs between the refrigerator, sink, and stove...

3 Easy Tips for Safer Food In Your Restaurant

Food safety should be a top priority for restaurant operators, as it protects customers, team members, and the brand from food safety incidents...

How to Drive Consistency and Accuracy in Your Stores: 3 Quick Tips

Consistently meeting or exceeding customers' expectations is a surefire way to maintain a loyal customer base. Customers are more likely to choose a...

How Pete’s Convenience Guides and Motivates Employees to Succeed

Operations leaders may find it challenging to consistently motivate employees and teams to achieve the organization’s goals. With countless tasks and...

5 Pro Tips from Industry MVPs to Boost Store Performance and Customer Experience

From the Super Bowl to burrito bowls - every winning team needs a playbook for success. Much like a sports playbook, your restaurant needs critical...

The Brady Bunch of 2023 Restaurant Tech

What does a 1970s sitcom have to do with restaurant tech in 2023? As pop culture’s quintessential blended family, the Brady Bunch demonstrated the...

How to Use Zenput APIs to Integrate Data and Build Custom Tools

Many restaurant operations teams find themselves using multiple different software systems daily. While each of these systems may play an important...

4 Tips to Identify and Address Operational Blindspots

In the foodservice industry, operational blindspots exist when there’s a good chance that things could go wrong and not be addressed quickly; ops...

How Huck’s Marketplace Develops High-Impact Leaders that Employees Trust

Most managers are promoted from the ground up in the service industry, meaning that many who find themselves in leadership positions do not have...

Perspective: The Future of Food Safety Tech from Nick Bouse of Love’s Travel Stops

In recent years, food safety technology has come a long way. More companies are tracking temperatures digitally, using automation to streamline...

How Wingstop Partnered with Franchisees to Digitize Operations for 1,700 Locations

When operating at a scale of hundreds or thousands of restaurants, brands often look to their franchisees for feedback on what tools to use and how to...

4 Lessons from California Pizza Kitchen on Embracing Technology for Restaurant Operations

Julie Castro, Director of Culinary Operations and Operations Services, has been with California Pizza Kitchen (CPK) for over two decades. During that...

Safety in Restaurants: How to reduce risk, create awareness, and build trust

Employees and customers need to feel safe every time they enter your restaurant – confident that food will be safe to eat, that accidents aren’t just...

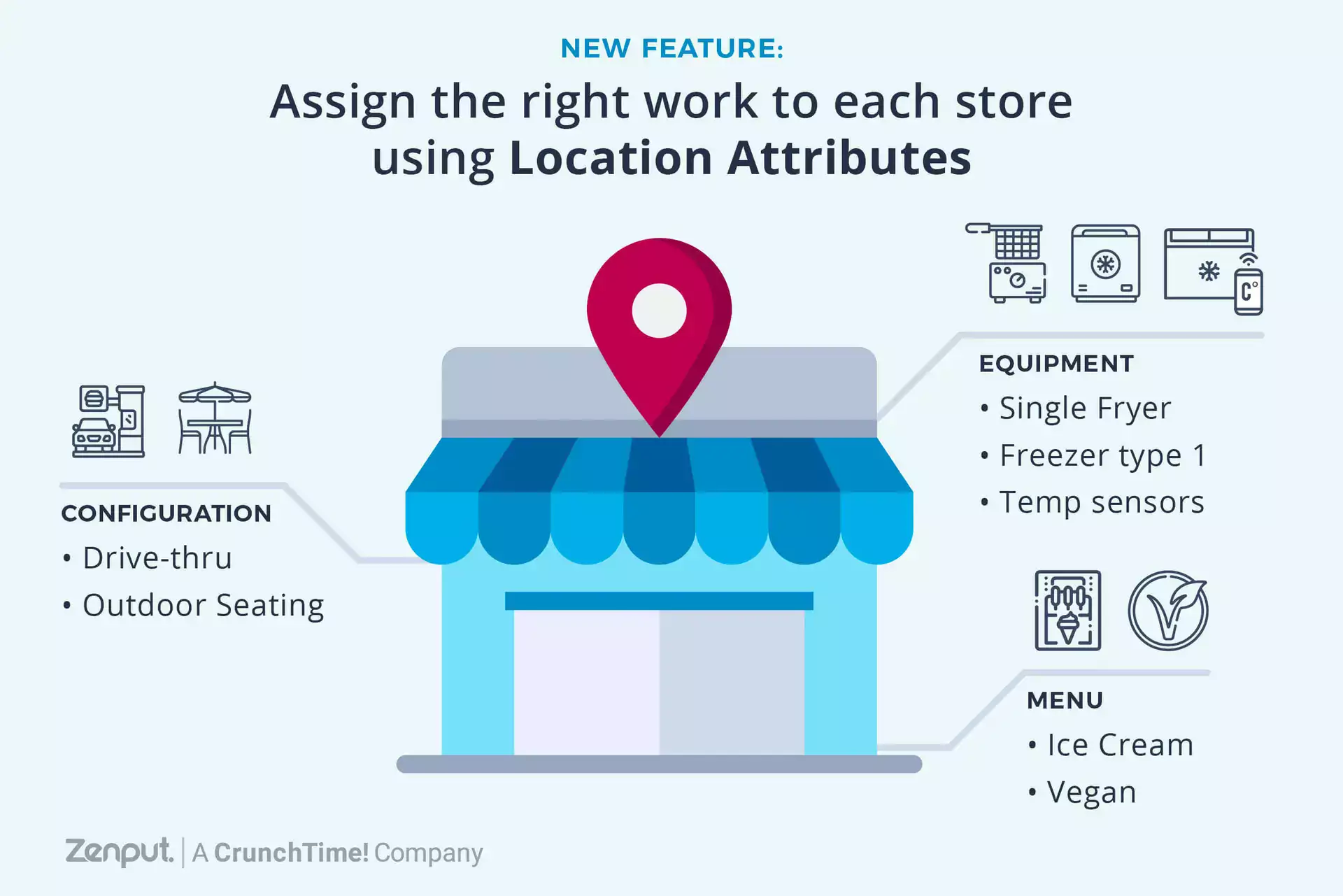

New from Zenput: Use Location Attributes to Drive the Right Work in Each Store

Standard operating procedures are standard for a reason: every one of your stores needs to do them. But what if one store has a drive-thru and the...

How friendly competition between stores can improve food safety compliance

The teams that serve food in your stores every day are the last line of defense for the health of your customers, and ultimately your brand. With this...

How RPM Pizza Automated Temperature Checks and Food Prep Labeling

Domino’s, like any business that serves food, must comply with food safety regulations. Although imperative for the health and safety of customers and...

An Inside Look at Chipotle’s Stage-Gate Process for New Products

Achieving operational excellence is a major challenge for any restaurant, but achieving it across thousands of locations is a whole different beast...

Food Safety Month: Your Strongest Defense Against Foodborne Illness? Healthy Employees

To help spread awareness for National Food Safety Education Month, we're spotlighting each of our four pillars of food safety execution throughout...

Food Safety Month: 3 Modern Approaches for Safer Food Preparation

To help spread awareness for National Food Safety Education Month, we’re spotlighting each of our four pillars of food safety execution throughout...

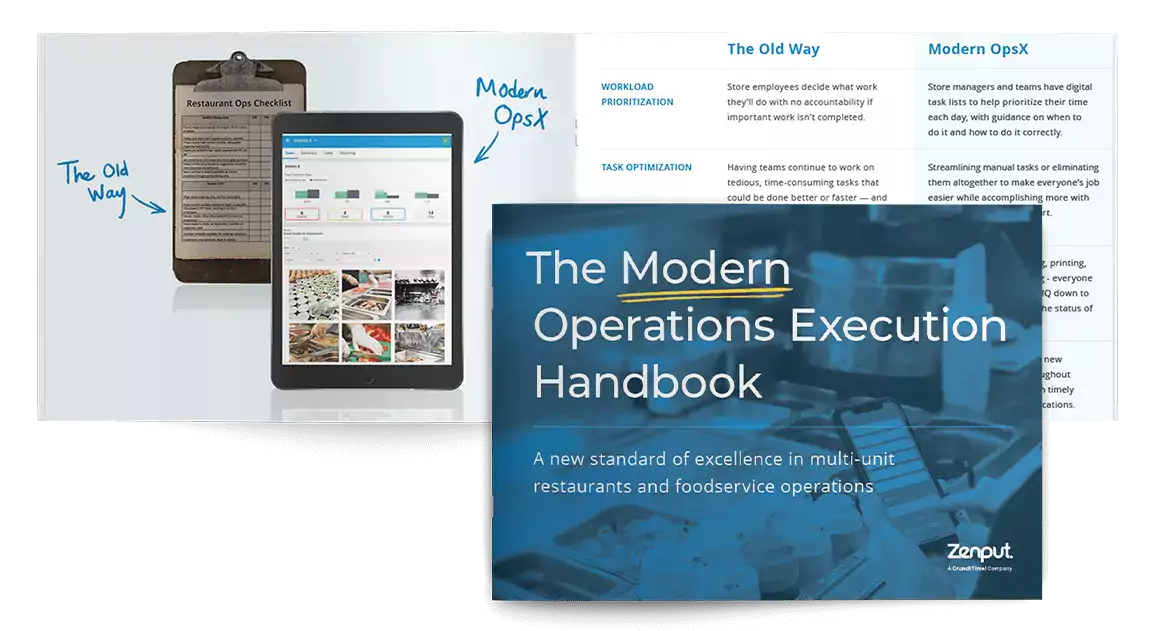

Modern Operations Execution: The Way Restaurant and Retail Teams Work Has Changed

Operations execution (OpsX) refers to the work that is actually happening in restaurants, convenience stores, supermarkets, and other retail outlets...

Food Safety Month: 3 Ways to Stay Out of the Temperature Danger Zone in Every Store

To help spread awareness for National Food Safety Education Month, we're spotlighting each of our four pillars of food safety execution throughout...